These items will be depreciated using Canada Revenue Agency’s depreciation (capital cost allowance) rates.

Capital additions such as computers, office furniture and musical instruments.Expenses that are 100% related to the business and will be deducted fully in the year incurred (e.g.In general, there are four main categories of expenses:

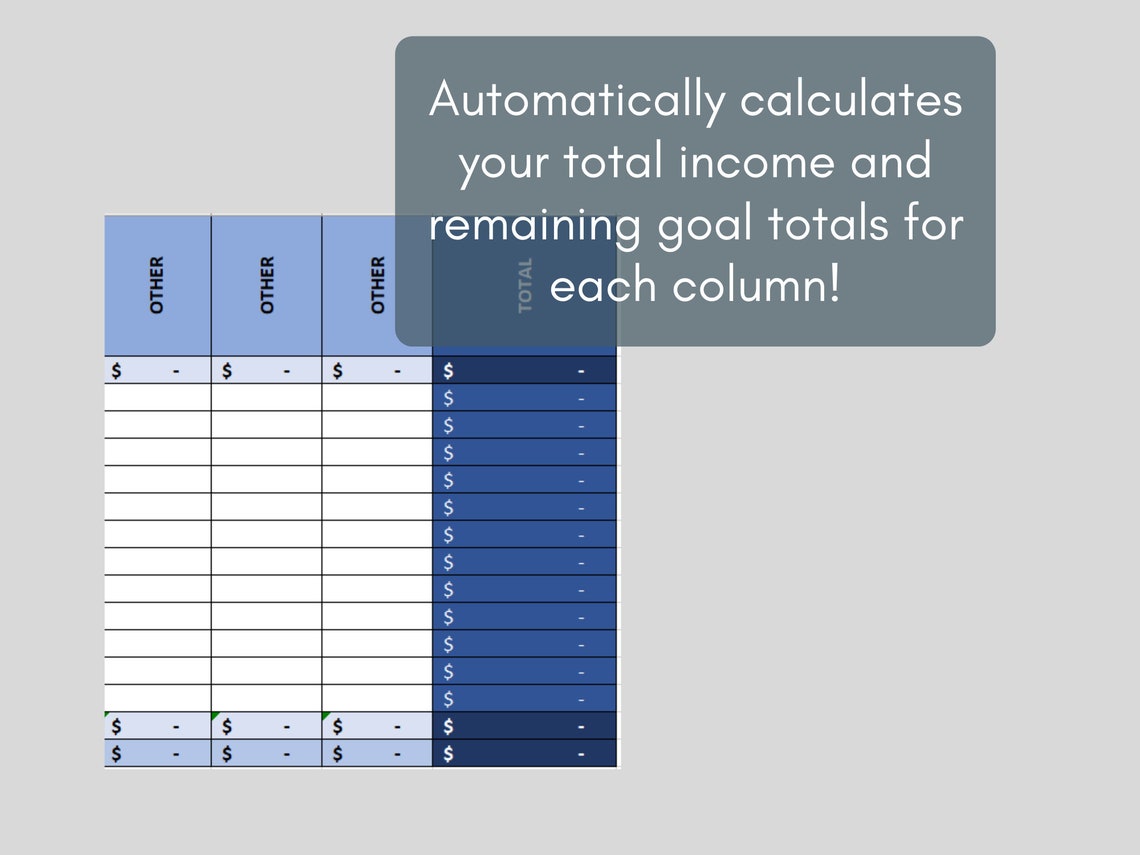

Similarly, any expenses incurred but not yet paid will also be reported.įor specific information on what expenses can be claimed, please see my Self-employed income and expense worksheets. Most businesses must use the accrual method, meaning that income that is earned in the calendar year must be included in revenue even if not received until after the year end. You will need to track your income and expenses for your new business. Tracking your self-employed income and expenses

0 kommentar(er)

0 kommentar(er)